- Claiming Gambling Losses On Tax Returns

- Claiming Gambling Losses On Tax Return Irs

- Claiming Gambling Losses On Tax Return Tax

- Claiming Gambling Losses On Tax Return 2017

Since the MGM casino opened in August, gamblers have reportedly wagered more than $428 million on MGM Springfield's slot machines that generated about $40 million in revenue for MGM and reportedly another $18.5 million in revenue from table games. This is in addition to the $2 billion or so per year wagered at the Plainridge Park Casino that generates $170 million in revenue. All of this revenue came out of the pockets of those eager to try their luck.

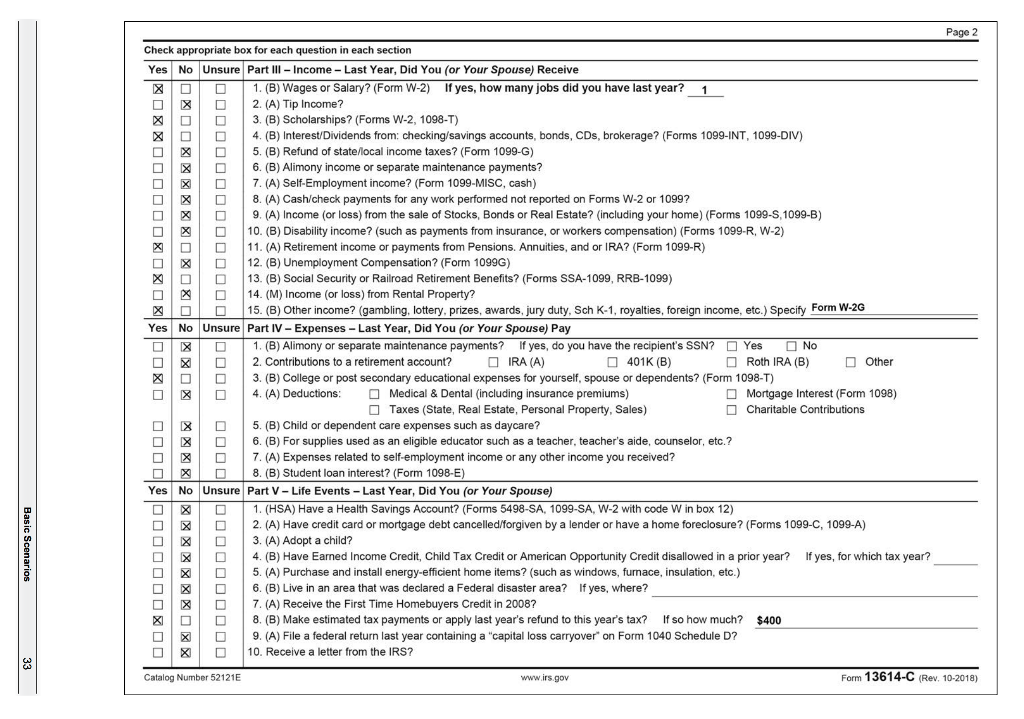

Oct 28, 2020 When you have gambling winnings, you may be required to pay an estimated tax on that additional income. For information on withholding on gambling winnings, refer to Publication 505, Tax Withholding and Estimated Tax.' Can I Deduct Losses?: You can deduct your gambling losses if you itemize on a Form 1040 Schedule A. You have to track all. For tax purposes, you cannot simply subtract your losses directly from your winnings. If you itemize deductions on your federal and state returns, your gambling losses may qualify as a deduction, but only to the extent of your winnings.

In Massachusetts, gross income is defined as federal gross income as defined in the Internal Revenue Code as of January 1, 2005 with certain modifications. Federal gross income is all income from whatever source derived unless specifically excluded. Federal gross income includes winnings from all types of gambling, including lottery, slot parlor and casino. However, federal law allows taxpayers to deduct their losses to the extent of any gambling winnings as an itemized deduction.

For example, if a taxpayer won $5,000 in a casino for federal tax purposes they could deduct losses up to the full amount of winnings. For taxpayers who gamble frequently, it would not be unusual for losses to equal or exceed winnings. So for federal purposes after the deduction for losses, it was possible that very little income was reported on the federal tax return. The burden is on the taxpayer to prove any losses (see Rev proc 77-29, 1977-2 CB 538).

Claiming Gambling Losses On Tax Returns

However, if the taxpayer was a Massachusetts resident, the full $5,000 would be included in Massachusetts income with no offsetting deduction. So if the taxpayer won $5,000 on a lucky visit to the casino but let it ride and actually lost all $5,000 of it, for federal tax purposes that taxpayer would have net federal income of zero. However, if the taxpayer lived in Massachusetts, the full $5,000 would be included in state income with no offsetting deduction so the taxpayer would pay state income tax on the full $5,000.

Claiming Gambling Losses On Tax Return Irs

Fortunately, the law that expanded gaming in Massachusetts contained provisions that allow taxpayers to deduct casino losses to the extent of gambling winnings. However, the law only applies to losses incurred at a gaming establishment licensed in Massachusetts.

Therefore, in the example above, if the Massachusetts taxpayer won $5,000 at the tables at MGM in Springfield, Massachusetts, and then took a trip to Connecticut and lost the $5,000 at the Mohegan or Foxwood casino, no deduction would be allowed when computing Massachusetts income tax.

Categorized:Gambling, Taxes

Watch Daniel Negreanu, Joe Hachem, Gavin Griffin, Chad Brown and Steve Paul-Ambrose from Team PokerStars Pro introduce the great ga. Aug 24, 2020 Badugi is a draw game gaining popularity in the poker world these days and for good reason - it's a very fun, action-packed poker game. Although it shares many aspects of its structure with other draw games, such as 2-7 Triple-Draw Lowball, Badugi uses an entirely distinct system for evaluating the winning hand.

Claiming Gambling Losses On Tax Return Tax

Oct 28, 2020 When you have gambling winnings, you may be required to pay an estimated tax on that additional income. For information on withholding on gambling winnings, refer to Publication 505, Tax Withholding and Estimated Tax.' Can I Deduct Losses?: You can deduct your gambling losses if you itemize on a Form 1040 Schedule A. You have to track all. For tax purposes, you cannot simply subtract your losses directly from your winnings. If you itemize deductions on your federal and state returns, your gambling losses may qualify as a deduction, but only to the extent of your winnings.

In Massachusetts, gross income is defined as federal gross income as defined in the Internal Revenue Code as of January 1, 2005 with certain modifications. Federal gross income is all income from whatever source derived unless specifically excluded. Federal gross income includes winnings from all types of gambling, including lottery, slot parlor and casino. However, federal law allows taxpayers to deduct their losses to the extent of any gambling winnings as an itemized deduction.

For example, if a taxpayer won $5,000 in a casino for federal tax purposes they could deduct losses up to the full amount of winnings. For taxpayers who gamble frequently, it would not be unusual for losses to equal or exceed winnings. So for federal purposes after the deduction for losses, it was possible that very little income was reported on the federal tax return. The burden is on the taxpayer to prove any losses (see Rev proc 77-29, 1977-2 CB 538).

Claiming Gambling Losses On Tax Returns

However, if the taxpayer was a Massachusetts resident, the full $5,000 would be included in Massachusetts income with no offsetting deduction. So if the taxpayer won $5,000 on a lucky visit to the casino but let it ride and actually lost all $5,000 of it, for federal tax purposes that taxpayer would have net federal income of zero. However, if the taxpayer lived in Massachusetts, the full $5,000 would be included in state income with no offsetting deduction so the taxpayer would pay state income tax on the full $5,000.

Claiming Gambling Losses On Tax Return Irs

Fortunately, the law that expanded gaming in Massachusetts contained provisions that allow taxpayers to deduct casino losses to the extent of gambling winnings. However, the law only applies to losses incurred at a gaming establishment licensed in Massachusetts.

Therefore, in the example above, if the Massachusetts taxpayer won $5,000 at the tables at MGM in Springfield, Massachusetts, and then took a trip to Connecticut and lost the $5,000 at the Mohegan or Foxwood casino, no deduction would be allowed when computing Massachusetts income tax.

Categorized:Gambling, Taxes

Watch Daniel Negreanu, Joe Hachem, Gavin Griffin, Chad Brown and Steve Paul-Ambrose from Team PokerStars Pro introduce the great ga. Aug 24, 2020 Badugi is a draw game gaining popularity in the poker world these days and for good reason - it's a very fun, action-packed poker game. Although it shares many aspects of its structure with other draw games, such as 2-7 Triple-Draw Lowball, Badugi uses an entirely distinct system for evaluating the winning hand.

Claiming Gambling Losses On Tax Return Tax

Claiming Gambling Losses On Tax Return 2017

Tagged In:casino, gambling losses, Income Tax, tax deduction